Navigating the Ups and Downs of Crypto Markets

Crypto markets have long been characterized by their cyclical nature, with distinct periods of rapid growth, correction, and consolidation. While short-term volatility can be unsettling, historical data reveals predictable patterns that investors can use to make informed decisions.

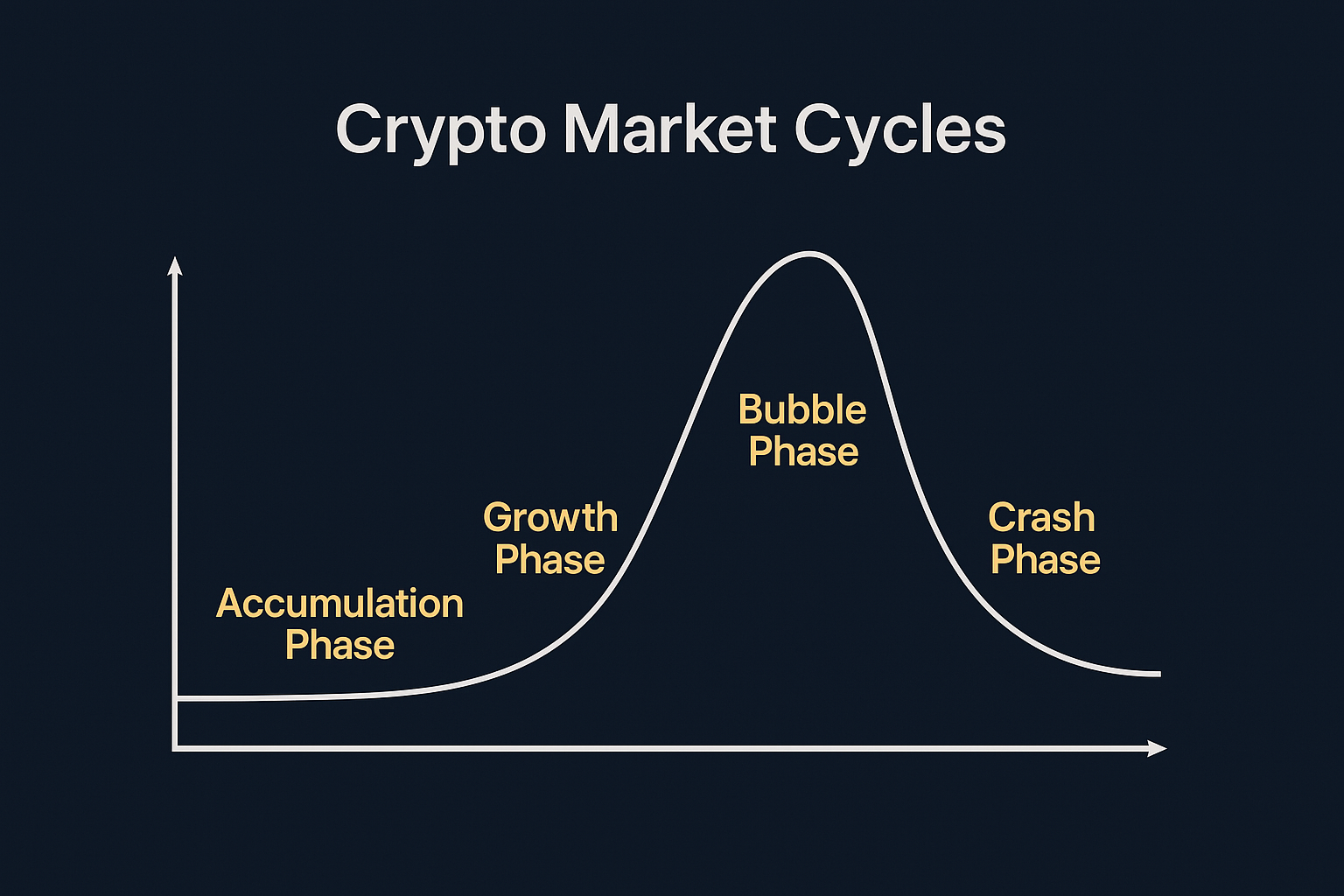

Understanding these cycles—accumulation, growth, bubble, crash—is key to maximizing returns while managing risk.

“Bitcoin follows a clear cycle, and those who understand it can make data-driven investment decisions.” – Fidelity Digital Assets, 2024

This blog explores crypto market cycles, their historical impact, and how investors can navigate them strategically.

Market Research & Data-Driven Insights

1. The Four Phases of Crypto Market Cycles

Reality: Crypto markets operate in well-defined cycles driven by investor psychology, liquidity, and macroeconomic factors.

- Accumulation Phase: Prices remain low, investors accumulate assets, and sentiment is cautious.

- Growth Phase: Adoption increases, institutional interest rises, and prices trend upwards.

- Bubble Phase: FOMO (Fear of Missing Out) drives speculative buying, pushing prices to unsustainable levels.

- Crash Phase: Market corrections occur, weak hands exit, and prices reset before the next cycle begins.

“Understanding where we are in the cycle is critical to making rational investment decisions.” – Bloomberg Crypto Report, 2024

2. Historical Bitcoin Cycles & Key Takeaways

Reality: Bitcoin has followed a repeating cycle approximately every four years, largely influenced by halving events (which reduce mining rewards, decreasing new supply).

Key Cycles & Market Behavior:

- 2013 Bull Market: Bitcoin surged from ~$10 to $1,100 before a major correction (-87%).

- 2017 Bull Market: Bitcoin hit $20,000 amid ICO mania, followed by an 84% correction.

- 2021 Bull Market: Bitcoin reached $69,000, fueled by institutional adoption, before falling 77% in 2022.

- Current Cycle (2024-2025?): Institutional adoption, ETF approvals, and macroeconomic trends suggest the next growth phase is unfolding.

“Bitcoin’s long-term price trajectory remains bullish despite cyclical downturns.” – J.P. Morgan Institutional Research, 2024

Real-World Case Studies

Case Study 1: Institutional Investment & Market Stability

- Bitcoin’s volatility decreased after major funds (BlackRock, Fidelity) entered the market.

- Institutional spot ETFs provided stability by reducing reliance on leveraged trading.

- Conclusion: Institutional involvement extends market cycles and smooths volatility over time.

Case Study 2: The Impact of Bitcoin Halving Events

- 2012 Halving: BTC price rose from $12 to $1,100 in the following year.

- 2016 Halving: BTC price moved from $650 to $20,000 in the next bull cycle.

- 2020 Halving: BTC jumped from $8,000 to $69,000 within 18 months.

- 2024 Halving (Upcoming): Investors anticipate a supply shock, historically triggering long-term price appreciation.

“The Bitcoin halving remains one of the most important events influencing supply and demand dynamics.” – ARK Invest, 2024

Addressing Pain Points & Misconceptions

Many investors hesitate due to misconceptions about market cycles

✅ “Crypto crashes mean Bitcoin is dead.” → Each cycle has ended with a higher low, reinforcing long-term growth.

✅ “It’s impossible to time the market.” → While timing is difficult, understanding macro trends and accumulation phases improves decision-making.

✅ “Only early adopters benefit.” → Institutional funds only entered in recent cycles, proving long-term potential remains.

Providing a Path Forward (Without Selling)

For investors seeking to leverage crypto cycles effectively:

- Recognize Long-Term Trends: Crypto markets are volatile in the short term but have shown consistent upward growth over multiple cycles.

- Diversify Across Market Phases: Investing strategically in accumulation and early growth phases reduces downside risk.

- Monitor Institutional Movements: Large investors often lead trends, offering clues about the next cycle.

Final Thoughts

While crypto volatility can be intimidating, historical cycles show that patient, informed investors have consistently benefited from long-term adoption trends. By understanding market phases, investors can make better decisions and reduce emotional reactions to short-term price movements.

“The key to success in crypto investing is managing risk while taking advantage of market cycles.” – BlackRock Digital Assets, 2024