The Growing Demand for Secure Crypto Investment Vehicles

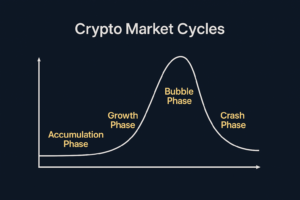

For high-net-worth individuals (HNWIs), the appeal of cryptocurrency as a portfolio diversifier and inflation hedge is undeniable. However, navigating the complexities of digital asset investments—from security risks to regulatory challenges—remains a significant barrier to entry.

Unlike retail investors, HNWIs require institutional-grade investment solutions that provide security, compliance, and ease of access. This blog explores how sophisticated investors can bridge the gap between traditional finance and crypto with structured, risk-managed investment approaches.

Market Research & Data-Driven Insights

1. The Shift Toward Institutional-Grade Crypto Investment Solutions

Reality: Institutional adoption has driven the rise of secure, regulated investment vehicles tailored for HNWIs.

- Bitcoin ETFs attracted over $10B in inflows in 2024, making crypto more accessible through traditional brokerage accounts (Bloomberg Crypto Report).

- Over 60% of family offices are now exploring crypto investments, according to Goldman Sachs’ 2024 Family Office Survey.

- Wealth management firms are integrating digital assets, offering structured investment solutions that align with HNWIs’ risk profiles.

“The infrastructure for institutional crypto investing has matured significantly in recent years.” – PwC Institutional Report, 2024

2. Understanding the Available Investment Vehicles

Reality: HNWIs have multiple secure options to gain exposure to crypto without dealing with self-custody or exchange risks.

- Crypto Funds & Hedge Funds: Managed investment funds like Bitward that offer diversified exposure to digital assets.

- Bitcoin Spot ETFs: SEC-approved funds that track Bitcoin price without requiring direct ownership.

- Crypto Yield & Fixed Income Products: Interest-bearing crypto accounts with structured risk mitigation.

- Tokenized Real-World Assets (RWA): Traditional assets like real estate and bonds represented on the blockchain.

“Family offices and institutional investors prefer managed exposure through structured products rather than direct trading.” – J.P. Morgan Private Wealth Report, 2024

3. The Role of Custody & Security in Crypto Investing

Reality: Secure custody remains one of the most important factors for HNWIs entering the crypto market.

- Institutional custody solutions (e.g., Coinbase Custody, Fidelity Digital Assets) ensure secure asset storage.

- Multi-signature wallets and cold storage provide protection against hacks and fraud.

- Insurance-backed custodial solutions add an additional layer of protection for investors.

“Secure custody services are a game-changer for HNWIs, eliminating the need for self-management of crypto assets.” – Bloomberg Institutional Crypto Report, 2024

Real-World Case Studies

Case Study 1: Family Offices Allocating to Crypto Through Funds

- 70% of surveyed family offices in the U.S. and Europe are investing in Bitcoin and Ethereum through managed funds.

- A large percentage prefer funds like Grayscale’s Bitcoin Trust or hedge funds specializing in digital assets.

- Conclusion: Structured products allow HNWIs to access crypto without dealing with operational risks.

Case Study 2: Sovereign Wealth Funds & Tokenized Assets

- Countries like Singapore and UAE are allocating sovereign wealth into tokenized real estate and securities.

- Tokenization reduces settlement times and improves liquidity for high-value assets.

“Tokenization is unlocking new opportunities for institutional investors, making traditional assets more accessible.” – World Economic Forum, 2024

Addressing Pain Points & Misconceptions

Many HNWIs hesitate due to misconceptions about crypto investing:

✅ “Crypto is too risky.” → Institutional funds and ETFs now provide regulated exposure with risk-managed structures.

✅ “Self-custody is complicated.” → Secure custodial services eliminate the need for private key management.

✅ “Crypto lacks legitimacy.” → Regulatory progress, institutional adoption, and Bitcoin ETFs confirm crypto’s growing role in finance.

Providing a Path Forward (Without Selling)

For HNWIs seeking secure exposure to digital assets:

- Explore Structured Investment Vehicles: ETFs, hedge funds, and custody-backed solutions provide secure access.

- Work with Institutional Custodians: Avoid security risks by utilizing regulated custodial services.

- Monitor Institutional Trends: Family offices, pension funds, and sovereign wealth funds are leading the way.

Final Thoughts

As the crypto investment landscape matures, HNWIs now have access to institutional-grade investment solutions that provide security, liquidity, and regulatory compliance. Understanding these options allows investors to enter the digital asset space strategically and securely.“Crypto is no longer just a speculative asset—structured investment solutions are making it a core component of wealth management.” – BlackRock Digital Assets, 2024