Choosing the Right Investment Strategy for Crypto

Crypto investing is not one-size-fits-all. Depending on risk tolerance, market knowledge, and time commitment, investors can choose between passive or active investment approaches. Each strategy has its advantages and challenges, and understanding them can help investors navigate the rapidly evolving digital asset landscape more effectively.

“Institutional investors are increasingly combining both passive and active strategies to optimize returns in the digital asset market.” – Fidelity Digital Assets, 2024

This blog explores passive and active crypto investment approaches, their benefits, risks, and how they fit into a diversified portfolio.

Market Research & Data-Driven Insights

1. Passive Crypto Investment: The Long-Term Approach

Reality: Passive investing focuses on long-term asset appreciation, requiring minimal management.

- Buy-and-Hold (HODL): Investors purchase Bitcoin, Ethereum, or blue-chip cryptos and hold them for years.

- Index Investing: Funds such as crypto ETFs or diversified index funds offer exposure to multiple digital assets.

- Staking & Yield Generation: Investors earn passive income by staking assets in proof-of-stake networks or providing liquidity in DeFi protocols.

Performance Trends:

- Bitcoin has delivered annualized returns of ~146% since 2011, despite periodic volatility (Source: Fidelity Digital Assets, 2024).

- Crypto ETFs and index funds have attracted over $10B in inflows in 2024 (Bloomberg Crypto Report).

- Staking rewards on platforms like Ethereum yield 4-6% APY, providing an alternative to traditional fixed-income investments.

“Long-term crypto investors who weather volatility tend to outperform short-term traders.” – ARK Invest, 2024

2. Active Crypto Investment: High Risk, High Reward

Reality: Active investing involves frequent market engagement to capitalize on short-term price movements.

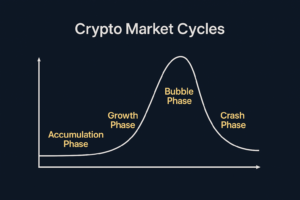

- Swing Trading: Buying and selling based on technical indicators and market cycles.

- Day Trading: High-frequency trading strategies to profit from intraday volatility.

- Arbitrage Trading: Exploiting price discrepancies across exchanges.

- DeFi Yield Farming: Moving assets between liquidity pools to maximize rewards.

Performance Trends:

- Active trading strategies can generate higher returns in bull markets but also carry greater downside risk.

- Successful arbitrage traders earn low-risk profits by exploiting inefficiencies in fragmented crypto markets.

- Top hedge funds employing active strategies have reported over 50% annualized returns in select years (PwC Crypto Hedge Fund Report, 2024).

“Active trading in crypto requires expertise and risk management, but it can provide outsized returns for skilled investors.” – J.P. Morgan Digital Markets, 2024

Real-World Case Studies

Case Study 1: MicroStrategy’s Long-Term Bitcoin Strategy

- MicroStrategy (Strategy) has accumulated over 190,000 BTC, leveraging a buy-and-hold approach.

- Their Bitcoin holdings have significantly outperformed traditional corporate treasury strategies.

- Conclusion: Passive accumulation has proven successful for corporate and institutional investors.

Case Study 2: Hedge Funds Using Algorithmic Trading

- Hedge funds use sophisticated quantitative models for active trading.

- Strategies include momentum trading, arbitrage, and derivatives trading.

- Conclusion: Institutional-grade active management can provide risk-adjusted returns when executed effectively.

“Hedge funds are leveraging algorithmic trading to optimize crypto exposure, balancing risk and reward.” – PwC Crypto Hedge Fund Report, 2024

Addressing Pain Points & Misconceptions

Many investors hesitate due to misconceptions about investment strategies:

✅ “Crypto is only for day traders.” → Long-term holding and passive index investing are viable strategies for wealth preservation.

✅ “Passive investing is too slow.” → Historical data shows buy-and-hold strategies have outperformed most active traders over time.

✅ “Active trading is easy.” → Risk management, discipline, and deep market knowledge are required for consistent success.

Providing a Path Forward (Without Selling)

For investors exploring crypto investment strategies:

- Define Your Risk Profile: Long-term investors benefit from passive strategies, while risk-tolerant traders may prefer active management.

- Consider Portfolio Diversification: A combination of passive holdings and active allocations can optimize returns.

- Monitor Institutional Trends: Hedge funds, ETFs, and pension funds are shaping the future of crypto investing.

Final Thoughts

Both passive and active strategies have their place in crypto investing. While passive approaches offer long-term stability and compounding growth, active strategies can maximize short-term opportunities but require expertise. Investors should carefully assess their goals, risk tolerance, and market understanding before choosing an approach.“A balanced portfolio incorporating both passive and active strategies may offer the best long-term results.” – BlackRock Digital Assets Report, 2024