Bringing Institutional-Grade Crypto Investment to High-Net-Worth Investors

The rise of digital assets has created exciting new opportunities for wealth creation, but for many high-net-worth individuals (HNWIs), the barriers to entry remain high. Navigating security risks, market volatility, and regulatory uncertainty can make crypto investing seem complex and intimidating.

“Crypto investing is evolving, and investors need a professional, structured approach to maximize returns while managing risks.” – BlackRock Digital Assets, 2024

This blog explores how Bitward’s investment approach is tailored for sophisticated investors looking to access digital assets safely and efficiently.

Market Research & Data-Driven Insights

1. Addressing the Key Challenges in Crypto Investing

Reality: Traditional investors face multiple hurdles when entering the crypto market.

- Security Risks: Hacks and scams have led to over $3.8B in crypto-related losses in 2023 (Chainalysis 2024 Report).

- Regulatory Concerns: Investors need compliant solutions that align with global financial regulations.

- Market Volatility: Bitcoin’s price swings have historically ranged between 40%-80% per year, making risk management crucial.

- Complexity & Accessibility: Unlike traditional markets, crypto requires specialized knowledge and infrastructure.

“A lack of institutional-grade infrastructure has kept many HNWIs from investing in digital assets.” – J.P. Morgan Institutional Report, 2024

2. How Bitward Solves These Challenges

Reality: Bitward’s structured investment approach provides solutions tailored for institutional and high-net-worth investors.

- Institutional-Grade Security: Assets are held with insured, regulated custodians.

- Regulatory Compliance: Bitward is structured under British Virgin Islands (BVI) regulatory frameworks with full KYC/AML compliance.

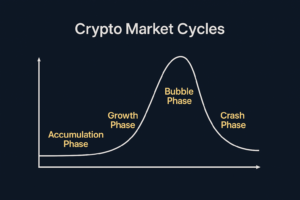

- Risk-Managed Strategies: Portfolio allocations are actively adjusted based on crypto market cycles and macroeconomic indicators.

- Diversified Investment Model: Exposure to Bitcoin, altcoins, DeFi, and tokenized assets ensures balanced risk management.

Addressing Pain Points & Misconceptions

Many investors hesitate due to misconceptions about crypto investing:

✅ “Crypto is too risky.” → Bitward’s risk-managed portfolio allocations ensure balanced exposure.

✅ “Regulations are unclear.” → Bitward operates within established regulatory frameworks, ensuring investor protection.

✅ “I don’t want to manage private keys.” → Institutional-grade custody eliminates the need for self-custody concerns.

Providing a Path Forward (Without Selling)

For investors looking to enter the digital asset space securely:

- Explore Structured Investment Vehicles: Bitward’s funds provide regulated, institutional-quality exposure.

- Focus on Risk Management: Crypto’s volatility can be mitigated through active portfolio management and diversified strategies.

- Learn from Institutional Trends: Major financial institutions are setting the stage for long-term crypto adoption.

Final Thoughts

The world of digital assets is evolving, and institutional-grade investment solutions like Bitward are making it easier than ever for HNWIs to access crypto securely, compliantly, and intelligently. By leveraging risk-managed strategies, regulatory compliance, and institutional custody, Bitward is redefining how traditional investors engage with the digital asset economy.

“Crypto is no longer just a speculative asset—structured investment solutions are turning it into a mainstream portfolio component.” – BlackRock Digital Assets Report, 2024

Conclusion: A New Era of Digital Asset Investing

For sophisticated investors, the time to explore institutional-grade crypto solutions is now. The financial landscape is shifting, and those who strategically integrate digital assets into their portfolios will be best positioned for the future.